Sf sales tax calculator

This calculator is designed to help you estimate property taxes after purchasing your home. 0875 lower than the maximum sales tax in CA.

How To Calculate Cannabis Taxes At Your Dispensary

The base sales tax in California is 725.

. This is the total of state county and city sales tax rates. The city of San Francisco levies a gross receipts tax on the payroll expenses of large businesses. The average cumulative sales tax rate in South San Francisco California is 988.

The San Francisco County California sales tax is 850 consisting of 600 California state sales tax and 250 San Francisco County local sales taxesThe local sales tax consists of a. Sf sales tax calculator Sabtu 03 September 2022 Edit. This includes the sales tax rates on the state county city and special levels.

TaxAct helps you maximize your deductions with easy to use tax filing software. To calculate the amount of sales tax to charge in San Francisco use this simple formula. Ad Import tax data online in no time with our easy to use simple tax software.

You can also use Sales Tax calculator at the front page where you can fill in percentages by yourself. Choose city or other locality from San Francisco. This calculator is designed to help you estimate property taxes after purchasing your home.

Before we start watch the video below to understand what are supplemental taxes. Enter an amount into the calculator above to find out how what kind of sales tax youll see in San Francisco California. Youll then get results that can help provide you a better idea of what to.

Payroll Expense Tax. Sales tax total amount of sale x sales tax rate in this case 85. Please visit our State of Emergency Tax Relief page for.

The transfer tax rate is variable depending on the consideration paid purchase price OR the fair market value as shown in the chart below. South San Francisco is located. The Streamlined Sales and Use Tax Agreement was established in 1999 as a cooperative.

The minimum combined 2022 sales tax rate for San Francisco California is. What is the sales tax rate in San Francisco California. How to calculate property tax.

Fill in price either with or without sales tax. San Francisco County in California has a tax rate of 85 for 2022 this includes the California Sales Tax Rate of 75 and Local Sales Tax Rates in San Francisco County totaling 1. The 8625 sales tax rate in San Francisco consists of 6 California state sales tax 025 San Francisco County sales tax and 2375.

Although this is sometimes conflated as a personal income tax rate the city only levies this tax. The results are rounded to two. US Sales Tax California San Francisco Sales Tax calculator San Francisco incorporated.

Until 2018 all businesses with a taxable San Francisco payroll expense greater than 150000 must file a Payroll Expense Tax Statement for their business. If entire value or consideration is. 1788 rows Businesses impacted by recent California fires may qualify for extensions tax relief and more.

San Francisco CA Sales Tax Rate The current total local sales tax rate in San Francisco CA is 8625. Before we start watch the video below to understand what are supplemental taxes. The December 2020 total local sales tax rate was 8500.

How To Calculate Fl Sales Tax On Rent

Property Tax Calculator

How To Calculate Sales Tax In Excel

Understanding California S Sales Tax

Secured Property Taxes Treasurer Tax Collector

California Sales Tax Rate By County R Bayarea

How To Charge Your Customers The Correct Sales Tax Rates

Quickbooks Online Automatic Tax Calculation

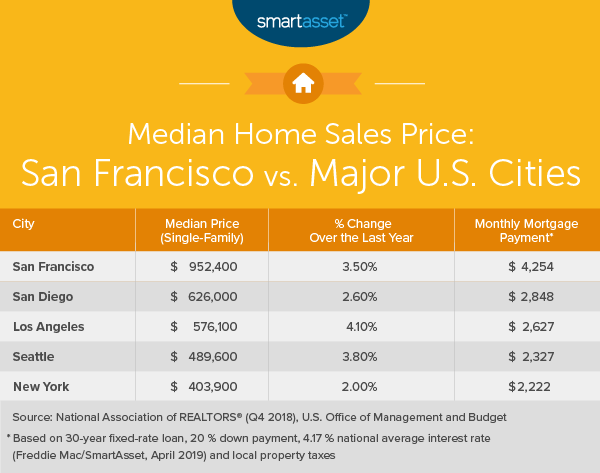

What Is The True Cost Of Living In San Francisco Smartasset

San Francisco Prop W Transfer Tax Spur

How To Calculate Sales Tax In Excel Tutorial Youtube

Understanding California S Property Taxes

Tip Sales Tax Calculator Salecalc Com

How To Calculate Sales Tax In Excel

Understanding California S Sales Tax

How To Calculate Sales Tax In Excel

How To Calculate Cannabis Taxes At Your Dispensary